Retail Credit Card Payment Processing

Twenty-nine percent of consumers prefer to pay with credit cards and 42% prefer to pay with debit cards, according to findings from the Federal Reserve Bank of San Francisco. If your small business doesn’t accept card payments, you could be losing business with customers who don’t want to carry cash for in-person purchases. Retail credit card payment processing can help your business catch up with the payment options these customers are looking for.

We’ll explain what retail credit card processing is, what you’ll need to accept credit cards at your business, how much it will cost, and which merchant service provider is best to use.

Retail credit card processing: what is it?

Retail credit card processing allows you to accept credit cards as payment at a physical business, such as a store or restaurant. This is different from online credit card processing, which allows you to accept credit card payments virtually.

Retail credit card processing is also different from debit card processing. Although both involve transferring money from one bank account to another, this is accomplished through a different process. In short, debit cards use funds directly from the customer’s bank account. Credit cards, on the other hand, rely on a line of credit provided by the credit card issuing bank. The issuing bank pays your company for the purchase and then the customer pays you back.

For this reason, credit card purchases generally cost your company more in fees than debit card purchases.

What is required to process credit cards in person?

To process credit cards in person as a retail business, a few things must be set up.

First, you will need a business bank account. You can set one up with the bank of your choice.

You will also need a traditional merchant account or TMA. Since it is not safe to move money directly to or from your merchant bank account, this account acts as a “holding tank.”

In addition, you will need a merchant service provider (MSP), such as Towerspay, or a payment service provider (PSP), such as Stripe, Square, or PayPal. The MSP or PSP will be the intermediary between you and the credit card issuing bank. This provider will ensure that the money you earn from transactions reaches your bank account.

Note that your MSP or PSP may open a merchant account for you. For example, Towerspay handles this step for you, making it even easier for you to get ready to accept credit card payments.

However, setting up accounts and choosing a service provider is only part of the game. You’ll also need some special equipment.

Equipment needed for credit card processing

When processing payments at a physical business, you’ll need some equipment. If you also want to accept mobile payments, that may require different equipment (or software).

For in-person payments, you will need a terminal device to read your customer’s credit card information. This device communicates with the credit card networks and banks involved in credit card transactions. As a merchant, you can also use advanced point-of-sale (POS) systems that perform many additional functions, such as inventory management and payroll.

If you use Towerspay as your payment processor, you’ll have a credit card machine and virtual terminal that simplify the acceptance of in-person transactions, online payments, and even payments via a mobile device. Our credit card terminals are Wi-Fi and EMV compatible, and allow you to accept the following payment methods:

Major credit cards, such as American Express, Discover, Mastercard, and Visa, include chip (EMV) cards.

- Debit cards

- Apple Pay (iOS)

- Google Play (Android)

- Contactless payments (tapping the card)

Retail payment processing payment

So how much does retail credit card processing cost? There are three categories of costs you need to consider. Money paid to retail credit card processors falls into one of these categories:

- Fee

- Rates

- Equipment Costs

Fee

There are many moving parts to credit card processing, and each of the companies involved needs to earn money for the service it provides. For example, the card network and the issuing bank charge transaction fees. The payment gateway and credit card processor also charge fees.

The main types of fees are:

- Interchange fees: these are set by the major card networks – American Express, Visa, Mastercard, and Discover. They help these companies offset risk and recover costs. Interchange fees are actually charged to the issuing banks, who then pass that cost on to business owners like you. As the most important cost involved in payment card processing, interchange fees can vary widely, depending on the type of card used, your type of business (e.g., if you are a high-risk merchant), and how it is presented. among other factors.

- Service or assessment fees: this fee goes directly to the credit card network. Also known as network fees.

- Marking fees: These are charged by the payment processor. These fees help defray the costs and risks associated with merchant account management.

Rates

The term “fees” refers to the pricing models MSPs and PSPs charge for their services. Here are four common pricing models:

- Flat-rate pricing: this is when a payment processor charges a flat fee for all debit and credit card purchases, regardless of the card used. This model is used by payment service providers such as Stripe, Square, and PayPal.

- Tiered rates: this is when a processor charges a fee that depends on the type of card and how it is presented. The tiers are arranged according to the volume of transactions on a given business day, as well as the risk involved in each transaction.

- Interchange-plus pricing: In interchange-plus pricing, merchants have debited a certain percentage of the sale, which is based on the interchange fee of the card being used. Usually, a small transaction fee is added.

- Subscription: Here, the processor assesses monthly fees to provide the service. They also usually charge a small fee per transaction.

Equipment costs

It is important to factor in equipment costs when considering how much retail credit card processing will cost. Some credit card processors offer free card readers. Others have equipment for sale, and other companies (such as Towerspay) will rent you the necessary equipment.

Entry-level credit card terminals provide a keypad, a display, a magnetic stripe card reader, and the ability to use chip (EMV) cards.

Other card readers offer wireless capabilities or are part of larger POS systems that include receipt printers, cash registers, and other add-ons.

A cost-effective retail payment processing solution

There’s no shortage of credit card processing services to choose from. But if you’re looking for an MSP that’s easy to use and cost-effective, check out Towerspay.

If you use Towerspay as your payment processor, you’ll have a credit card machine and virtual terminal that make it simple to accept in-person transactions, online payments via email or an e-commerce site, and even payments via a mobile device.

Towerspay’s credit card terminal is available for only $35 per month. It supports Wi-Fi and EMV, and allows you to accept the following payment methods:

- Major credit cards, such as American Express, Discover, Mastercard, and Visa, include chip (EMV) cards.

- Debit cards

- Apple Pay (iOS)

- Google Play (Android)

- Contactless payments (tapping the card)

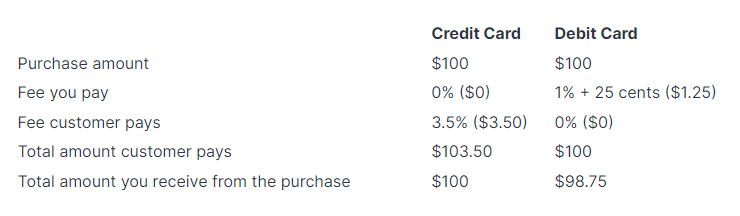

Typically, businesses must pay processing fees when accepting credit cards, usually around 3.5% of each transaction.

With Towerspay’s surcharge program, however, the customer will cover the costs. This makes the surcharge program a very cost-effective and transparent pricing model. It allows you, as a merchant, to get $100 out of a $100 transaction. There are no hidden costs or fees involved.

Towerspay’s payment solution gives your customers a choice. If they want to use a credit card, they will pay a 3.5% surcharge. But if they want to avoid the fee, they can pay by cash or debit card. This program actually encourages customers to use cash or a debit card.

For example, here’s how the same $100 purchase would work depending on whether the customer paid by credit or debit card.

Towerspay is 100% compliant with the law, works with credit card installment plans, and provides 24/7/365 customer service – because every customer is a VIP!

Start accepting credit card payments at your business

These days, it’s important to be able to accept credit cards in your business. As a merchant, you’ll need a merchant bank account, a merchant account, and a merchant service provider. And you’ll need the necessary equipment, such as a credit card terminal or point-of-sale system.

Paying for retail credit card processing is a complex business. So be aware of the fees, rates, and equipment costs involved.

You have many choices when it comes to merchant service providers. One of the best choices you can make is to use Towerspay, a leader in the payment card industry. If you’re ready for cost-effective retail credit card processing, contact Towerspay today.